State of the Dairy Nation 2024/25: DairyNZ Highlights Record Milk Production and Export Growth

DairyNZ's chief executive Campbell Parker says the 2024/25 dairy season reinforces the importance of the dairy sector to New Zealand.

Last month saw the annual release of the DairyNZ Economic Farm Survey and the NZ Dairy Statistics.

These fascinating documents contain a wealth of data on the average physical and financial performance of 316 randomly selected owner-operator herds during the 2016-17 production season.

Several things stand out in the survey, the main one being how well farm profit and return on asset have recovered after the previous season’s very low payout.

During the 2016-17 season, on average, farmers received $5.79/kgMS for their milk. As a result of the tough previous season, farmers have learned how vital cost control is and despite a 48% lift in payout there was virtually no lift in farm working expenses/kgMS.

Some commentators may be tempted to use the last two season’s data to push to de-intensify dairy farms, saying that high input farms are less profitable than lower input farms. However, such a conclusion would deny the long-term results of the survey.

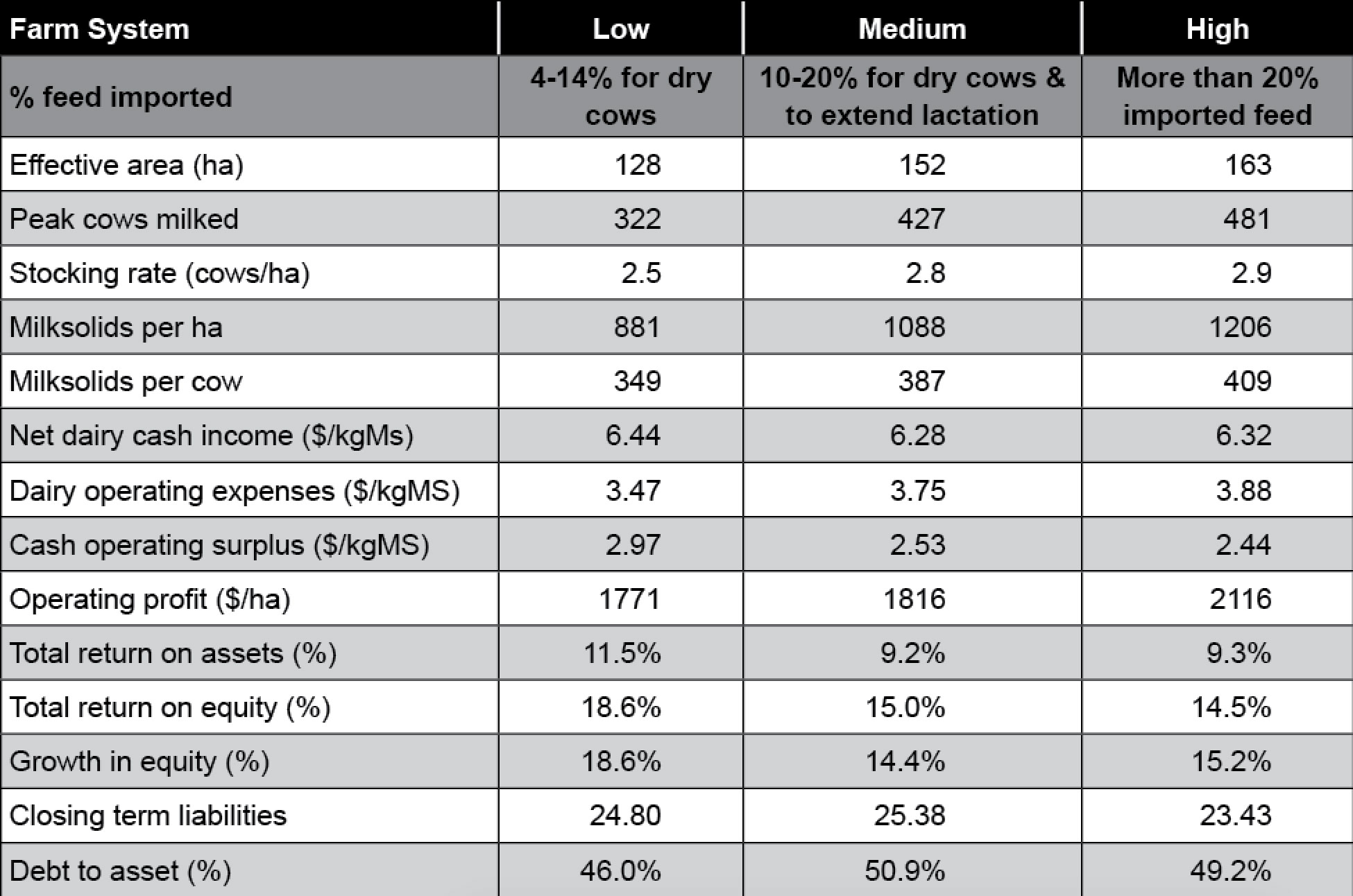

An analysis of the past twelve seasons (Table 2) shows that on average, high input systems made more money, had the highest return on assets and now also have the lowest closing term liability/kgMS.

The data is quite clear. Over the last 12 years, on average, high input systems have made the most profit/ha, have had the best return on assets and equity, have had the best growth in equity and are less financially risky in terms of their closing liabilities/kg milksolids.

The data is quite clear. Over the last 12 years, on average, high input systems have made the most profit/ha, have had the best return on assets and equity, have had the best growth in equity and are less financially risky in terms of their closing liabilities/kg milksolids.

Intensification is not wrecking the profitability of NZ dairy systems. And going on the previous 12 seasons’ figures, I predict that this season’s payout will reinforce the decision many farmers have made to intensify, i.e. their decision was correct.

However, as we now know, profitability is not the only issue farmers are facing.

In next month’s column I hope to cover things that farmers can do practically to reduce their environmental and biosecurity risks.

• Ian Williams is a Pioneer forage specialist. Contact him at This email address is being protected from spambots. You need JavaScript enabled to view it.

Recent weather events in the Bay of Plenty, Gisborne/Tairawhiti, and Canterbury have been declared a medium-scale adverse event.

DairyNZ's chief executive Campbell Parker says the 2024/25 dairy season reinforces the importance of the dairy sector to New Zealand.

A New Zealand agribusiness helping to turn a long-standing animal welfare and waste issue into a high-value protein stream has won the Australian dairy sector's top innovator award.

OPINION: A bumper season all around.

Dairy Women's Network (DWN) has announced that Taranaki dairy farmer Nicola Bryant will join its Trust Board as an Associate Trustee.

Rural Women New Zealand (RWNZ) says it welcomes the release of a new report into pay equity.

OPINION: Staying with politics, with less than nine months to go before the general elections, there’s confusion in the Labour…

OPINION: Winston Peters' tirade against the free trade deal stitched with India may not be all political posturing by the…