NZ Catchment Groups Thrive with ‘Source to Sea’ Approach

The most successful catchment groups in NZ are those that have 'a source to sea' approach.

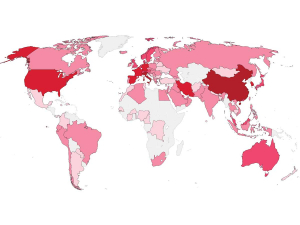

With over 130,000 cases worldwide Coronavirus isnow a pandemic. Dark areas have more than 10,000 cases.

With over 130,000 cases worldwide Coronavirus isnow a pandemic. Dark areas have more than 10,000 cases.

Covid-19 is forecast to strip more than $1.3 billion dollars off New Zealand’s primary exports in the coming year, including $390 million off dairy exports.

This latest revelation comes in the Ministry for Primary Industries latest Situation and Outlook Report, released late last week.

In December MPI were forecasting that primary exports for the year ending June 2020 would be $47.8 billion – now this has been reduced to $46.5 billion, a mere 0.5% up on the 2019 total. It is also warning of further downward revisions. The report came out the day World Health Organisation declared coronavirus a pandemic.

The report states that while the geopolitical tensions on trade such as Brexit and the US-China trade war have eased somewhat, coronavirus has added new uncertainty for NZ primary exporters. It notes that the seafood and forestry sectors have been particularly badly hit. But it points in the last month dairy commodity prices have softened and the average price on the GDT fell 7.5%.

It says there has been weakness in milk powders, butter, and anhydrous milk fat. However, despite the disruptions in Chinese markets, North Asian buyers have continued to be active in recent auctions, with volumes traded higher than at the same time the previous year. It adds that prices for cheese and casein have continued to strengthen.

MPI predicts that continued declines in key commodity prices will impact farm gate milk price payouts but it says given the strength of current export prices, strong payouts are still likely and will continue to support dairy farmer profitability this season. It say an average payout of $7.15/kgMS is likely.

Fonterra will announce its half-year results this week: coronavirus is likely to have an impact.

Accoriding to MPI, while revenue from the dairy sector is down on the December forecast, it is still ahead of the previous year and is expected to earn about $19.2 billion. The report also notes that despite the drought in the major dairying regions milk production for the first eight months of the season was up by point five of a percent.

Meat and horticulture exports have also taken a hit with revenue from meat down by $220 million and horticulture by $110 million.

The as yet unknown factor says the report is the fate of the NZ dollar which has already weakened since the beginning of this year. MPI says should the weakening in our key agricultural commodity prices continue to worsen, they would expect further adjustments in the NZ$ to help offset some of these effects for primary sector exporters. And MPI warns further revisions downward in future forecasts are likely.

Recent weather events in the Bay of Plenty, Gisborne/Tairawhiti, and Canterbury have been declared a medium-scale adverse event.

DairyNZ's chief executive Campbell Parker says the 2024/25 dairy season reinforces the importance of the dairy sector to New Zealand.

A New Zealand agribusiness helping to turn a long-standing animal welfare and waste issue into a high-value protein stream has won the Australian dairy sector's top innovator award.

OPINION: A bumper season all around.

Dairy Women's Network (DWN) has announced that Taranaki dairy farmer Nicola Bryant will join its Trust Board as an Associate Trustee.

Rural Women New Zealand (RWNZ) says it welcomes the release of a new report into pay equity.

OPINION: Staying with politics, with less than nine months to go before the general elections, there’s confusion in the Labour…

OPINION: Winston Peters' tirade against the free trade deal stitched with India may not be all political posturing by the…