The Oceania spot butter price hit a record high in June 2024 surging past US$7,000/tonne for the first time. However, the latest Global Dairy Trade saw a 10% drop and prices are now around US$6,546/MT.

Behind these soaring butter prices is a combination of supply and demand fundamentals for dairy fat and cream. Sluggish milk supply growth in the Northern hemisphere during the seasonal flush is limiting surplus milk available for manufacturing.

New Zealand is now into its milk production hiatus, helping to curb supply in the short term. Inventories in international supply chains are not excessive, leaving spot purchasing vulnerable. Furthermore, there is a seasonal increase in demand for fat products, like ice creams, in the northern hemisphere at this time of the year.

Butter pricing is outperforming the broader dairy complex. In June 2024, spot prices (in USD terms) for the other main dairy commodities were flat to slightly higher. Skim milk powder is particularly languishing behind other dairy commodities, lingering over 10% behind five-year average prices. For farmers, this is good news. Butter prices are one of the reference commodity products which make up Fonterra's farmgate milk price calculation.

Beef

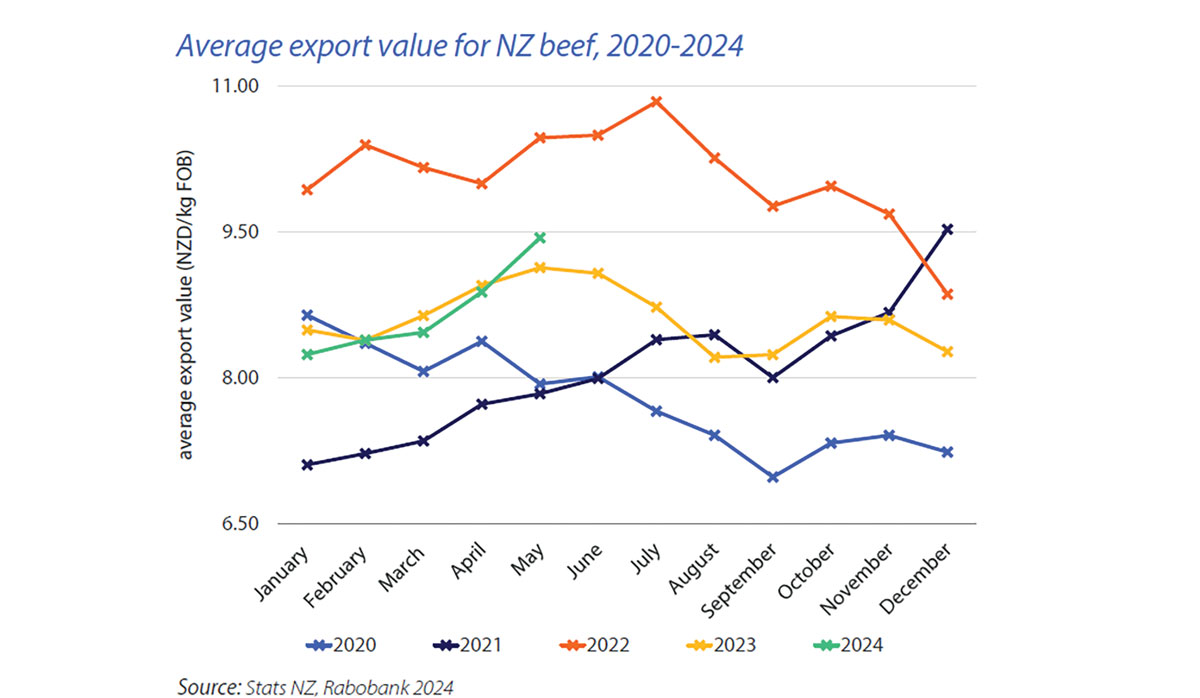

Both procurement pressure and a strengthening pull in certain export markets are driving positive beef farmgate prices this winter. Averge export values reached $9.44/kg in May 2024, the highest seen since the 2022 calendar year.

Looking at conditions on farm, rain has fallen widely across New Zealand in the past two weeks, with some eastern North Island areas receiving more rain than desired. Other parts of the country saw good, steady rain to help dry conditions. Where conditions aren't too wet under foot and there is some good cattle feed around, farmers have the option for winter liveweight gains. Wet areas 14,400 tonnes in May and 45% in value to $97.8m. The US has now moved ahead as the largest market for New Zealand beef by both volume and value for this season to date.

Beef exports to Japan surged ahead compared to May 2023 with volume to China, RaboResearch forecasts New Zealand farmgate beef pricing to remain strong in coming months.

Sheepmeat

There's some good news for export values - and there may be more good news in months to come. Average export values for lamb were $10.42/kg FOB for the month of May, the highest year-to-date values and the highest seen since September/October 2023. Perhaps some more positivity is on the horizon with lamb and mutton prices following a pleasing trend upwards as winter settles in - albeit still below the five-year average range.

Another win for sheepmeat producers: Saleyard store pricing for lamb has increased with the renewed positive pricing potential for early spring lamb schedules along with procurement pressure from farmers incentivised to hold numbers on farm. Prices paid in both islands took an upward leap by NZc10 to NZc30/kg lwt, although, as winter knuckles in, this demand may slow by August. Total slaughter numbers for lamb nationally sat at just over 14.7m to 1 June 2024, 8% ahead of last year. In Rabobank's view, the bulk of the lamb flock is now processed.

|

|---|

|

Lamb prices are tipped to rise this season.

|

Meanwhile, the mutton kill is tracking 6% behind last year thanks to weaker prices. With lamb slaughter numbers slowing at this point in the season, procurement pressure from processors and export demand are adding some positive upside to schedules.

In May, export volumes to China still led the way for New Zealand lamb at 12,900 tonnes. However, this figure represents a 26% decline compared to May last year. Total export value for lamb to China is down $59m YOY with mutton down $20.6m compared to the same period last year. EU-27 and UK exports continue to perform well for lamb volumes: up 25% and 38% YOY in May, respectively, with the EU-27 taking close to 7000 tonnes, and the UK at 5300 tonnes. Other big players for lamb exports this May were Canada, Japan, and Saudi Arabia by both volume and value. Demand from these markets outside of China is helpful for farmgate price resilience.

Dmand from the EU-27, the UK, and the US for New Zealand lamb has positive potential for the 2024-25 season.

Farm Inputs

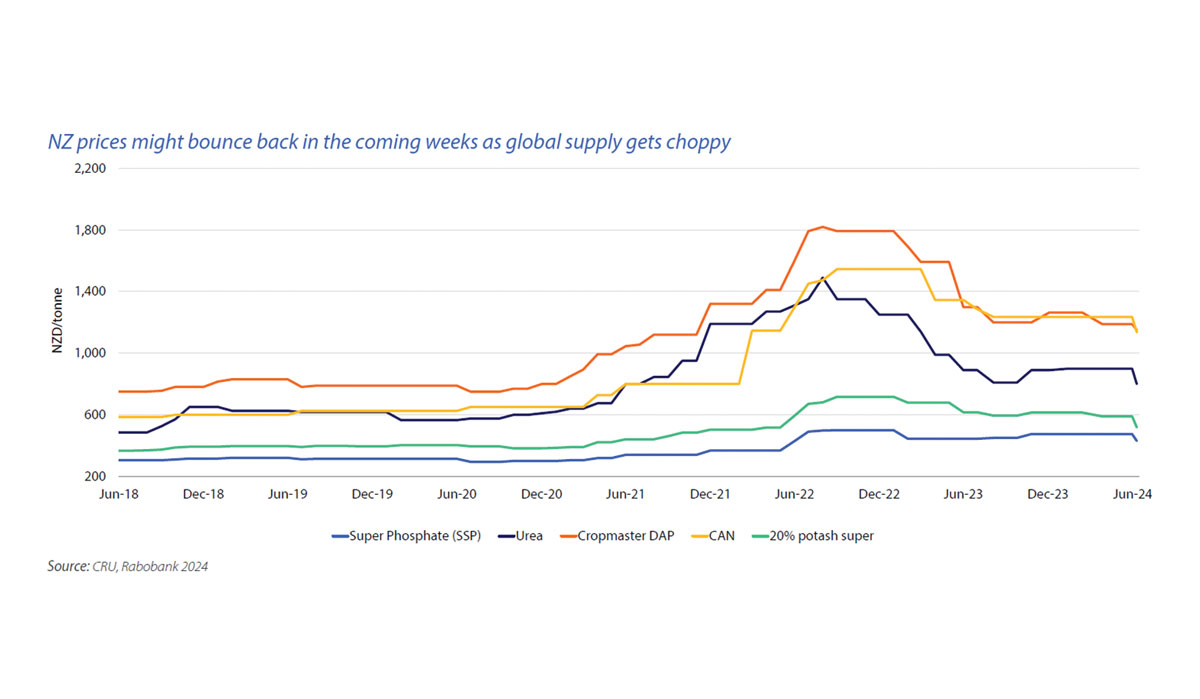

Urea prices ticked higher in June. Recent price action has turned more bullish, and one factor that will likely continue to provide support is China. The country has placed further restrictions on urea exports. Initially the expectation was for exports to resume in August but it's now unclear how long the halt will last.

One factor you would expect to add some downward pressure to global pricing is Egyptian plants, which are now back online. The news is a boost to global supply, especially given uncertainty regarding how long the disruptions would last.

Last month we highlighted the risk of container shipping rates, which could result in higher farmgate prices for farm inputs. So far in June, the WCI shipping indext has continued its dramatic rise and is now trading at levels not seen since September 2022. The ongoing Red Sea crisis is continuing to absorb capacity, and the Houthis are intensifying their attacks (as visible in the most recent drone/missile attack in mid-June). Meanwhile, port congestion remains a problem across several regions.