Fonterra Suppliers Confident in Mainland Dairy Future

Fonterra's 460 milk suppliers in Australia, who will switch to Lactalis end of this month, are unfazed with the impending change.

A former New Zealand Dairy Board marketing executive believes Fonterra should retain its consumer business but change the way it's running the business.

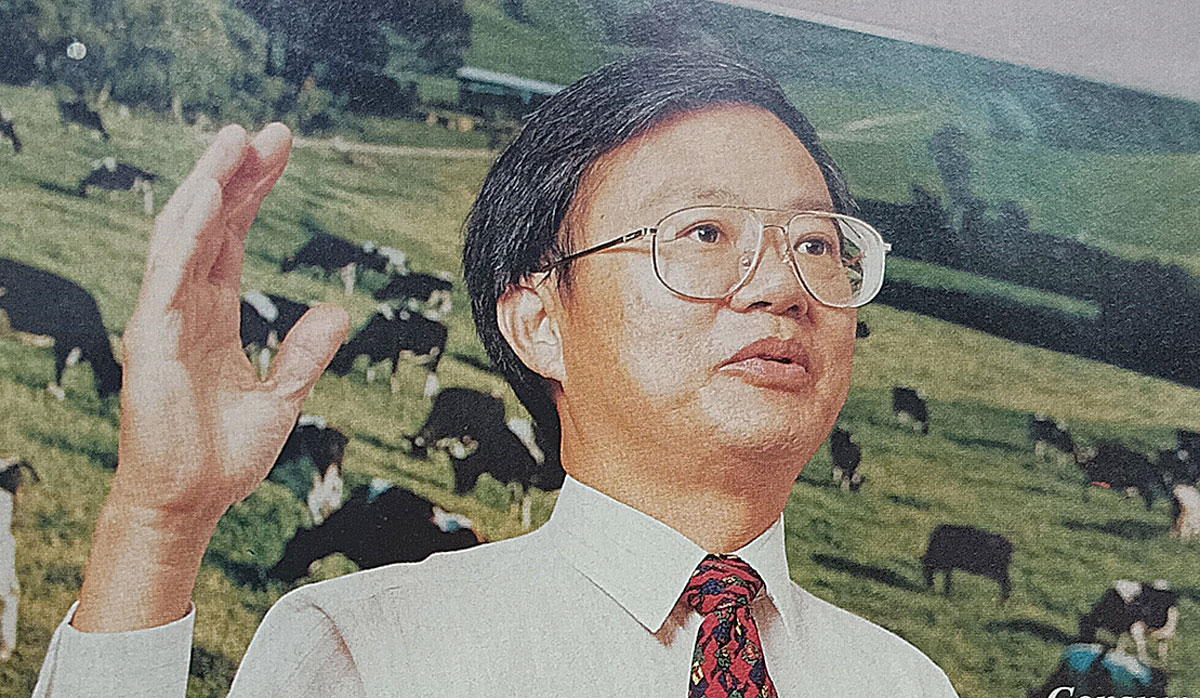

Dr Poh Seng Ong, a former chief executive officer Asia region of NZDB, says he's sad to read that Fonterra is deliberating to sell its consumer business.

Ong believes Fonterra's consumer business will continue to perform strongly is there's support from the top, who are usually non-consumer professionals.

He also believes Fonterra must recruit suitable people to run its consumer business.

"I use the word 'suitable' instead of 'top marketing' because different phases of marketing consumer growth require different marketing people."

Speaking to Dairy News from Singapore, where the 79-year-old lives in retirement, Ong noted that during the era of the NZDB, the consumer business was a steady business with non-volatile pricing/revenue.

He says the returns were much better than the commodity business.

"The consumer business helped the farmers in two ways: consistently higher returns buffered the low payout to farmers when commodity prices were down. Remember that commodity business competes on price," he says.

"Secondly, with more milk going into our own consumer business. it meant there was less milk to sell as a commodity. This resulted in less pressure on the commodity prices."

Last month, Fonterra announced a step-change in its strategic direction, setting out on becoming a world-leading provider of high-value, innovative dairy ingredients.

As part of this, the co-op said it was exploring full or partial divestment options for some or all of its global Consumer business, as well as its integrated business Fonterra Oceania and Fonterra Sri Lanka. Fonterra's global Consumer business includes a portfolio of market leading brands such as Anchor, Mainland, Kāpiti, Anlene, Anmum, Fernleaf, Western Star, Perfect Italiano and others.

Ong recalls that in the 1980s, NZDB bosses decided to extract more value out of milk by going into the consumer business. Commodity prices were depressing, he adds.

"In 1986, I was recruited in Singapore to turn the Malaysia company around. The Malaysian company was mainly in the consumer business. It was losing money for several years. None of the consumer brands were market leader or close to market leadership. The two brands of milk powder, Anchor and Fernleaf, were the lowest-priced milk powder in the market, and each had market share, at no more than 1% or 2%," he says.

In 1988, Fernleaf full cream milk powder was 're-launched'. The Anchor brand was discontinued.

Ong says, within three years, the Ferneaf full cream milk powder became either No. 1 in market share, with a market share of around 23%, or a close No.2 to Nespray, a Nestle brand, which was the unchallenged market leader in Malaysia for year, until then.

"The company became highly profitable and all the initial investments in the launch were recouped.

"In 1991, I created the brand Anlene for the skim milk powder category. In a record time of less than six months, I pushed the R&D to formulate the product I wanted in Anlene."

Anlene skim milk powder was launched in Malaysia in 1991. It was the most expensive skim milk powder in Malaysia and the gross product margin was over 45%.

Ong says it was a resounding success.

"Within one year, Anlene was market leader with market share at over 60%. By then the Malaysian company was the biggest consumer milk powder company in Malaysia, giving higher returns to dairy farmers than the commodity milk powder business.

"I then got the R&D to develop a milk powder for pregnant and breastfeeding women. I called this brand Anmum. Again, it immediately became No. 1, outselling Sustagen, a brand owned by American company Mead Johnson. The gross profit margin of Anum was even higher than Anlene: it was 60%."

Ong says the success was repeated in Singapore and Taiwan.

All these three markets - Malaysia, Singapore and Taiwan - were highly profitable, giving higher returns to dairy farmers than the commodity milk powder.

|

|---|

|

Dr Poh Seng Ong, a former chief executive officer Asia region of NZ Dairy Board. |

Good Old Days

Dr Poh Seng Ong says that during time, New Zealand Dairy Board had several strengths – top R&D and support for the consumer business from the board and management.

“During my time, the scientists at the Dairy Research Institute at Palmerston North were top class. We had one-week meetings, twice a year. At each meeting, we were pushing the other to get things going forward.

“On my marketing side, I pushed the R&D to develop products that I believed the market needed, while the R&D kept pushing me to market-research their new ideas/development. Those meetings were very productive.”

Ong says back then the consumer business had the full support of the NZDB board including then chair Sir Dryden Spring and senior management.

“Farmer directors from NZ Dairy Group, Kiwi Dairy Co-op and Northland Dairy Co-op visited the Asian markets and were very supportive.

“All these farmers were inspiring, interfacing with us in the marketplace. We in the marketplace appreciated that dairy farmers worked all day long, every day, seven days a week, except for the one or two winter months. We were a team together. Morale was high.”

DairyNZ Chair Tracy Brown has seen a lot of change since she first started out in the dairy sector, with around one-third of dairy farmers now women.

Castle Ridge Station has been named the Regional Supreme Winner at the Canterbury Ballance Farm Environment Awards.

The South Island Dairy Event has announced Jessica Findlay as the recipient of the BrightSIDE Scholarship Programme, recognising her commitment to furthering her education and future career in the New Zealand dairy industry.

New Zealand and Chile have signed a new arrangement designed to boost agricultural cooperation and drive sector success.

New DairyNZ research will help farmers mitigate the impacts of heat stress on herds in high-risk regions of the country.

Budou are being picked now in Bridge Pā, the most intense and exciting time of the year for the Greencollar team – and the harvest of the finest eating grapes is weeks earlier than expected.

OPINION: Expect the Indian free trade deal to feature strongly in the election campaign.

OPINION: One of the world's largest ice cream makers, Nestlé, is going cold on the viability of making the dessert.