Farm sales dropped slightly, according to data released today by the Real Estate Institute of New Zealand.

There were 14 less farm sales (-3.6%) for the three months ended February 2019 than for the three months ended February 2018.

Overall, there were 370 farm sales in the three months ended February 2019, compared to 420 farm sales for the three months ended January 2019 (-11.9%), and 384 farm sales for the three months ended February 2018.1,472 farms were sold in the year to February 2019, 3.6% fewer than were sold in the year to February 2018, with 24.1% less dairy farms, 11.6% more grazing farms, 5.8% less finishing farms and 4.2% fewer arable farms sold over the same period.

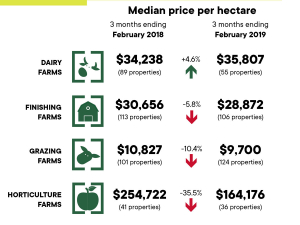

The median price per hectare for all farms sold in the three months to February 2019 was $22,462 compared to $27,523 recorded for three months ended February 2018 (-18.4%). The median price per hectare fell 17.1% compared to January 2019.

The REINZ All Farm Price Index rose 1.2% in the three months to February 2019 compared to the three months to January 2019. Compared to February 2018 the REINZ All Farm Price Index rose 12.9%. The REINZ All Farm Price Index adjusts for differences in farm size, location and farming type, unlike the median price per hectare, which does not adjust for these factors.

Eight of the 14 regions recorded increases in the number of farm sales for the three months ended February 2019 compared to the three months ended February 2018. Taranaki (+8), Hawke’s Bay (+7) and Gisborne (+6) were the top regions to increase the number of farm sales compared to February 2018. Bay of Plenty recorded the most substantial decline in sales (-16 sales) followed by Otago (-11 sales). Compared to the three months ended January 2019, four regions recorded an increase in sales with the biggest increase being in Taranaki (+4 sales).

Brian Peacocke, Rural Spokesman, at REINZ says the easing in total sales volumes for the three month period ending February 2019 is the main point contained in the sales data just released, particularly so for the dairy sector.

“Weather conditions have again been a major influence with a booming later spring followed quickly by an extremely dry summer period leading into semi-drought and fire hazard conditions in many parts of the country.

“Healthy product returns continue to reward diligent producers with real strength being shown in the beef, lamb, grain, timber and horticultural categories and partly in response to a weather-induced reduction in dairy output, pleasing improvements in the Global Dairy Trade auction prices for the dairy sector.

“For some farmers, however, those returns have not been sufficient to change their decision to exit the rural industry, as evidenced by the high number of farms on the market in recent months, these decisions in turn being based on frustrations relating to issues including, but not limited to, labour, compliance and margin-squeezing cost increases,” he says.