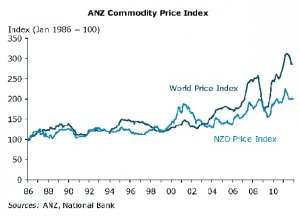

ANZ's Commodity Price Index shows a retreat in world price levels but it is still above previous peaks. Relative to history, world prices for most commodities New Zealand exports are still either at historical records, or not too far off.

There's a number of factors we see working in favour of the New Zealand commodity prices staying close to historical highs.

A weaker global scene is a clear risk, but not yet a reality. Certainly we see Europe slipping into recession, but other pockets are trading okay. However, it is clear the downside risks to the outlook are significant.

The main driver on the demand side has come from emerging market economies as they shift to becoming net importers of protein and other key foodstuffs in many instances. This support is expected to continue.

Worldwide cost of production is up on many fronts via land values, wages, increasing food safety and animal welfare standards, oil and energy prices flowing into transportation and packaging, and the introduction of new technology to increase efficiency and quality of products. These cost increases have been particularly prevalent in emerging countries.

Weather is also a factor in some key areas for specific commodity production, such as drought in the southern US states affecting beef and drought in Argentina and Brazil impacting corn and soybeans.

An increase in the global growing area of grains has been on more marginal land, with a more volatile climate; there are good reasons why many areas have not been cropped prior to now. This increases the marginal cost of production and provides greater risk of failure.

In many cases where there has been an increase in supply, this has been required to replenish inventory levels at historical lows and remaining so.

Government responses to high food inflation and the civil unrest it has caused in parts of the globe have supported a softening in prices rather than an implosion, which has been the historical experience.

Looking forward, we've pencilled in for soft commodity in-market prices to ease from the highs posted early in 2011, but to remain at elevated levels. The first half of this year will see further softening and is likely to present a number of challenges, particularly for those industries more reliant on Europe as a market. The buffer for farm-gate returns will be New Zealand's floating currency if things become too messy.

Looking beyond cyclical turns, we are optimistic the long-term trend for commodities is up. However, we would caution against excessive hype, with the trend likely to be slow moving. There will be consumer price resistance, speculators entering and exiting the market, unfriendly government intervention, other substitutes becoming viable and a supply-side response to strong prices.

Belarus is a recent example of supply side response, the former Soviet bloc nation emerging as a major supplier of dairy products. Its share of world cheese exports is now 7% and its growing skim milk powder (SMP) exports stand at 80,000 tonnes – or one-third of US SMP exports.

Any or all of these things can upset the apple cart.

• Con Williams is rural economist at ANZ. For more on ANZ's Agricultural Price Preview email This email address is being protected from spambots. You need JavaScript enabled to view it.