A total of 108,800 tractors were registered across Europe in the first six months of 2022, with 31,900 tractors of 37kW (50 hp) and under and 76,900 of 38kW and above.

Industry advocate CEMA suggests that 81,800 of these vehicles are agricultural tractors, the rest made up of vehicles, sometimes classified as tractors, which includes quad bikes, side-by-sides and telehandlers.

Agricultural tractor registrations for the half year decreased by 8.1% compared with the same period in 2021, having started on par in Jan- Feb, but falling away as the geo-political situation in Europe deteriorated because of the Ukraine-Russia conflict.

While the number of agricultural tractors registered in the first half of 2022 was still the second highest in at least eight years, since March disruptions have led to both bottlenecks in the supply of raw materials and components to manufacturers and price increases for those same goods.

Additionally, concerns are also being reported over the possible impact of measures aimed at preparing Europe for potential future energy supply disruptions and high prices, that combined will have a significant impact on the industry.

Interestingly, the demand for tractors and agricultural machinery in Europe remains robust, helped no doubt by strong agricultural prices, which according to the global food price index published by the United Nations Food & Agriculture Organisation (UN FAO), reached unprecedented levels earlier in the year.

Nevertheless, at the same time, farmers were also challenged with a similar unprecedented rise in prices for some key inputs, such as fuel, fertiliser and animal feed. With prices likely to remain volatile for some time, the future of farm incomes is highly uncertain.

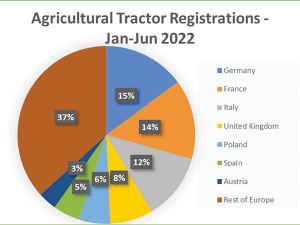

Agricultural tractor registrations declined in each of the seven largest European markets, although France and Germany still accounted for almost 30% of all tractors registered, with falls of 7% and 5%, respectively.

Italy, Poland and Spain, all of which saw very high registrations in 2021, have recorded faster declines in 2022, with falls of 12%, 14% and 14% respectively.

Over the English Channel in the UK, registrations were down 6% on the same six-month period of 2021. However, orders for tractors and farm equipment remain very strong, with the main problem being delivery lead times of over six months, or even longer for the likes of foragers and combine harvesters. It is taking even longer to get other mobile machinery, such as harvesters, to their end user.

This is likely to lead to strong registration data, even if orders start to slow down.

Price increases and bottlenecks on the supplier side continue to challenge the industry, and, although a slight easing has been observed, around, 31% of the companies are planning temporary production stops due to shortages in the next two months.