Those were the prophetic words from Master of Wine Direceu Vianna Junior, who addressed the recent Lallemond conference in Blenheim. Which is the reasoning behind his idea of surveying consumers, wine journalists and buyers regarding their preferences. His gut instinct was that consumers were being forgotten in the melee of the wine world, with too much emphasis being placed on what critics and buyers liked.

Junior also believes that could be why wine volumes are dropping in the UK and will continue to do so unless the issue is addressed.

“If we don’t do something for the low involvement consumer, we are losing them,” he told the conference.

“The UK figures are telling us we are going backwards on volume, we need to do something.”

With the backing of the Institute of Masters of Wine and Lallemand, a social survey has been established, with New Zealand playing an integral part. That was a deliberate decision Junior said.

“It made sense to do something with New Zealand as you have developed an amazing image in the consumer’s mind for premium, added value.”

With the help of Saint Clair Family Wines in Marlborough, the survey began.

Four Sauvignon Blancs, from four individual sites and in four different styles were produced in 2017. The four styles were tropical, herbaceous, citrus and barrel fermented. Each wine was labelled differently (see below) and were all tasted blind by a panel of UK individuals, selected by MW student, Sarah Benson, also the wine buyer for The Co-op in the UK.

At pains to point out this survey was not scientifically based, the aim was to discover which style consumers preferred. But alongside a panel of 247 frequent wine consumers (meaning they buy wine every two weeks), Benson also included 20 wine journalists and 20 buyers. They were asked how much they typically spent on a bottle of New Zealand Sauvignon Blanc. Interestingly Benson said, the consumers and journalists were much more aligned to what they “typically” spent on a bottle New Zealand Sauvignon Blanc than the buyers, who were in a higher price bracket.

All four of the Saint Clair wines were tasted blind in differing orders and each wine was accompanied by a list of 10 questions. Individually the participants had to express their aroma and flavour preferences between each of the wines, list which provided descriptors they felt were accurate, as well as being given the chance to provide descriptors of their own.

All four of the Saint Clair wines were tasted blind in differing orders and each wine was accompanied by a list of 10 questions. Individually the participants had to express their aroma and flavour preferences between each of the wines, list which provided descriptors they felt were accurate, as well as being given the chance to provide descriptors of their own.

And that is where the first anomalies between each of the groups raised its head. Take the citrus style Sauvignon Blanc for example.

The differences between what consumers smelt and tasted were very different to what journalists and buyers did.

The consumers used more simplistic vocab Benson said. “Are we talking their language?”

It was a similar picture when it came to the tropical and herbaceous wines. Consumer’s had a wider range of descriptors than either the journalists or buyers, with very few corresponding crossovers. The only wine that showed any similarities in terms of descriptors was the barrel fermented style, with oaky being the dominant word used by all three groups.

So what about when it came to deciding which wine was the most preferred? Was there any corresponding crossover between what consumers liked, and what the journalists and buyers preferred?

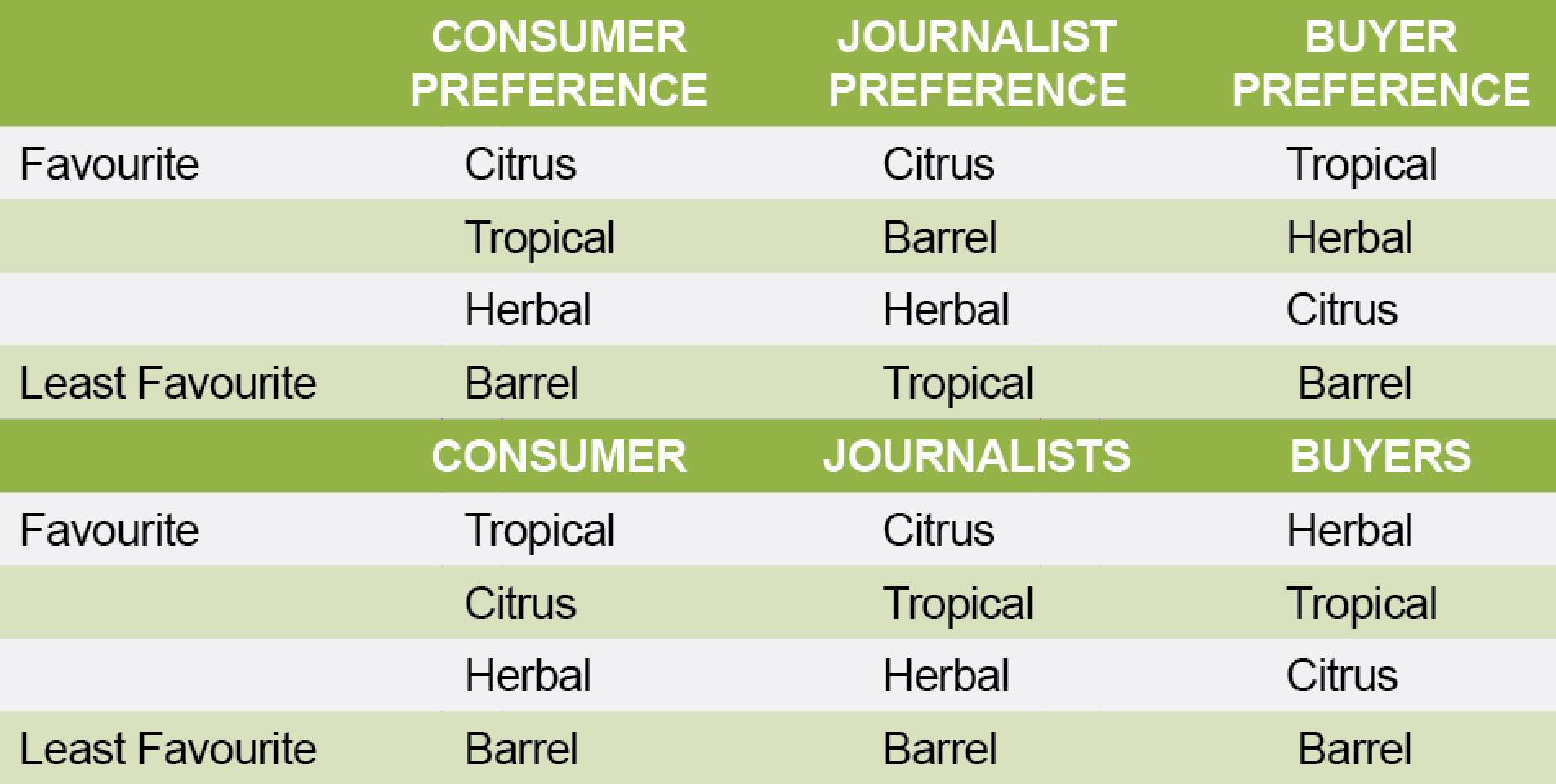

Above is the Aroma preferences for each group.

“Interesting with the buyers, you almost have an inverse preference for the wines, compared to the consumer,” Benson said. “The question is, are the buyers buying what the consumer wants, or are they buying what they (personally) like?”

It is a similar story when it comes to flavour preferences.

“Journalists and consumers are on the same page, but once again the buyers are different to both, almost inverse.

“There are so many differences between the buyer preference and the consumer preference, it is a wake-up call,” Benson says. “Are we buying the right wines to begin with? And should production be driven more by consumer preference?”

That is a question that will require answering if the volumes of wine sales continue to drop in the coming years. Is enough being done to attract consumers or has too much emphasis been placed on the wrong end of the chain – what buyers like and prefer?