Damien O’Connor: NZ united on global trade

When it comes to international trade, politicians from all sides of the aisle are united, says Labour's trade spokesman Damien O'Connor.

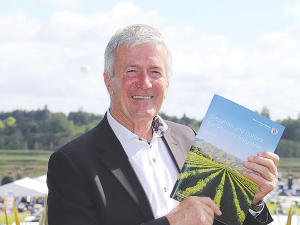

Agriculture Minister Damien O’Connor with a copy of the SOPI report released in December 2022, which says that horticulture exports for the year ended June 30, 2022 were $6.7 billion.

Agriculture Minister Damien O’Connor with a copy of the SOPI report released in December 2022, which says that horticulture exports for the year ended June 30, 2022 were $6.7 billion.

The latest report on the state of NZ primary exports shows that the value of horticultural exports has slowed and that the outlook for the coming season is fraught with challenges.

The Situation Outlook for Primary Industries (SOPI) is a quarterly report produced by the Ministry for Primary Industries (MPI) designed to provide a snapshot of the current dollar returns for our primary exports. It also forecasts likely outcomes over the next two years and provides commentary on global issues affecting the primary sector.

In its most recent report, released in December, MPI says that horticulture exports for the year ended June 30, 2022 were $6.7 billion - a 2% increase on the previous year, which was itself a modest 1% increase on the 2020 season.

The report also predicts that in 2023 the value of hort exports will hit just over $7 billion, but it's the wine industry that is driving this rise. Of concern, and perhaps not unexpected, is that the revenue from kiwifruit will be down by more than $400 million. While the figures for apple export returns are expected to rise, there is conjecture about whether this may actually happen due to climatic conditions last spring.

Looking at kiwifruit, MPI is upfront in stating that the sector is facing some challenges, some of which are new and some - namely fruit quality - are a hangover from the previous season. The issue of soft fruit arose in the past season and Zespri has a major investigation underway to find out the reasons for this and to come up with effective mitigation strategies.

One obvious reason is that fruit picking was rushed due to labour shortages and not enough attention was paid to quality control. Also some of the pickers and those in post-harvest operations lacked experience. There is some hope that things may improve in the coming season.

However, the big worry remains what effect the terrible frost that hit growers in the Bay of Plenty and Waikato last October will have this harvest. Some growers lost their entire crop, others part of it and some were not affected at all.

MPI is predicting that the 2022/23 kiwifruit crop will be down by 10%, others have suggested this could be as high as 20%. The answers will only be known when the fruit appears on the vines and growers assess how it looks when picking begins.

The problems of the last two seasons will hit growers in the pocket. Poor quality fruit will see returns down and this will be compounded by rising input costs. The effects of the frost will hit growers in 2024 when they get paid for this season's crop; some may get no income at all.

MPI is also predicting that apples are also facing a challenging season. While export returns are expected to rise to $2.4 billion, again, question marks hang over this. The reason is that climatic conditions for pollination and fruit set in spring were variable, with some orchardists describing the situation as disastrous. This comes on top of a poor 2020/21 season, which saw export volumes at their lowest level since 2015.

How Bad Could It Beg?

While the figures themselves and some of the narrative paints a somewhat negative picture, the SOPI report uses the words 'positive' and 'recovery' to inject some optimism into the equation.

It points to the ongoing demand for high quality fresh fruit in our main markets. But like all primary producers, the same headwinds remain, such as worldwide rising inflation, Covid, shipping and other logistical delays. There are also questions over the availability of sufficient quality labour right through the supply chain and the fragility of some markets.

China is the second largest market for our horticultural exports - just behind the EU. While it has the advantage of being closer to NZ than Europe, there remains concern about Covid lockdowns and other disruptions.

And then it's the state of the NZ dollar, which has helped prop up returns.

Agriculture Minister Damien O'Connor says the kiwifruit industry has grown strongly but he concedes there is now a need for different systems to combat the climatic variations that are being experienced. He says it's a challenging time for the industry and the sooner the primary sector gets on with dealing with climate change the better.

"It's not for the Government to dictate what growers should do," O'Connor says.

"All we can do is give them clear guidelines and get the market signals back to them. Horticulture has traditionally been very good at getting market signals back to their growers and they in turn have adapted and changed."

The outcome of the 2022/23 season is unclear given the number of variables at play and all the modelling in the world may not be able to predict the final outcome and MPI admits as much.

The World Wide Sires National All Day Breeds Best Youth Camp Best All Rounder plaudit has become family affair, with 2026 Paramount Cup winner Holly Williams following in her sister Zara's footsteps.

DairyNZ is giving New Zealand farmers a unique opportunity to gain hands-on governance and leadership experience within the dairy sector.

Herd improvement company LIC has posted a 5.2% lift in half-year revenue, thanks to increasing demand for genetics.

According to the latest Fresh Produce Trend Report from United Fresh, 2026 will be a year where fruit and vegetables are shaped by cost pressures, rapid digital adoption, and a renewed focus on wellbeing at home.

The Roar is a highlight of the game hunting calendar in New Zealand, with thousands of hunters set to head for the hills to hunt male stags during March and April.

OPINION: The past few weeks have been tough on farms across the North Island: floods and storms have caused damage and disruption to families and businesses.