Conditional agreement that Fonterra would buy the milk processing assets of NZDL was announced by receiver BDO on June 15, following the May 18 announcement that the formerly Russian-owned business was in receivership.

BDO said conditional on Commerce Commission clearance, the Fonterra deal would see NZDL’s outstanding payments to farmers made in full.

“We strongly believe it provides the best possible outcome for farmers and indeed all key stakeholder groups in the company,” said BDO’s Brian Mayo-Smith.

Last week Fonterra told Dairy News it was still talking to suppliers about coming on board. It was also confident of the commission’s support.

Suppliers group chairman Robert Borst told Dairy News they hadn’t been paid for April’s milk or retrospective payments that were also due May 20. Last week’s payment for May deliveries had only covered those made since receivership (May 18).

“It’s been very hard on suppliers. You go from expecting a milk cheque which you use to pay all your wages and expenses, to nothing. For a lot of farmers, including myself, it’s put an additional strain on the business, not to mention the emotional stress.”

Borst confirmed the receivership and missed payments were effectively a breach of contract by NZDL so suppliers could choose to walk away from supply deals which, in some cases, were for up to five seasons.

However, the suppliers group is united and to date none have done so, he says.

“We’ve always known that as a supply group we’ve got to stick together. Half the value of the business [NZDL] is in the plant and land assets but there’s an equal value in the milk supply.”

Early last season (September 2011) NZDL lost a chunk of supply to Synlait when the 51% Chinese-owned Dunsandel-based processor bought the remnants of another South Canterbury start-up venture, Oceania.

At the time about 20 supply agreements were said to be involved, however Dairy News understands not all switched to Synlait.

Borst says the loss of volume to Synlait would certainly have affected the profitability of NZDL which wasn’t at capacity this season, but whether receivership would have been avoided had they stayed he didn’t know.

“When the Russians didn’t spend the money on putting in an infant formula plant, that was really the downfall. The [5t/hr] plant’s just not big enough. It needs a specialist plant.”

The current supplier group involves 26 or 27 farmers with about 35 agreements.

The Commerce Commission says it expects an application from Fonterra by the end of the month for clearance of the deal under section 66 of the Commerce Act.

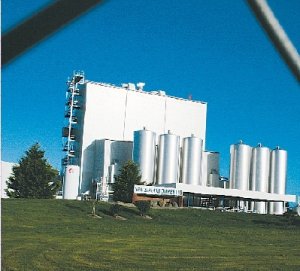

“In addition we will be investigating under section 27 of the Commerce Act the operational agreement Fonterra has entered into with New Zealand Dairies Ltd (in receivership) to keep the Studholme plant running through the 2012/13 milking season, or until a sale is completed,” a spokeswoman said.

“Section 27 prohibits any agreement that may substantially lessen competition in a market. We will run both investigations concurrently.... I can’t give you an indication of timeframes, however we aim to complete clearance decisions in 40 working days, although the actual time will vary depending on the complexities of the case,” he says.